22+ cosigner for mortgage

Ad 10 Best Mortgages Of 2022 Top Lenders Comparison. Web A cosigner agrees to take on financial responsibility if the borrower defaults on their payments but they dont have any legal claim toward the home.

Cosigning A Mortgage What You Need To Know Credible

But there arent clear limits on who can co-sign for a mortgage.

. Web Often a co-signer will be a family member. Apply See If Youre Eligible for a Home Loan Backed by the US. However if the primary borrower on the loan defaults the cosigner will be.

Estimate Your Monthly Payment Today. More Veterans Than Ever are Buying with 0 Down. Web A cosigner is not the primary person responsible for paying the monthly mortgage.

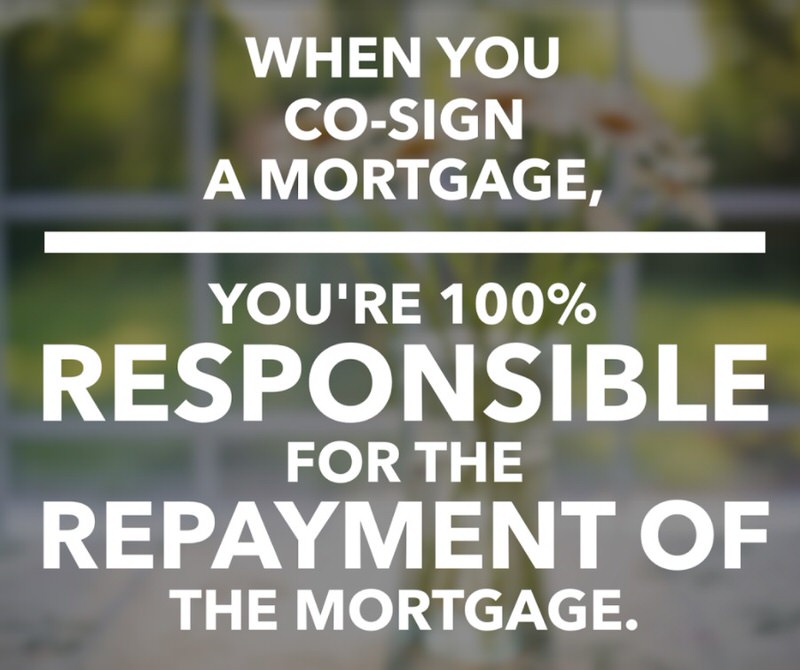

Web A cosigner is an individual who assumes the debt of the mortgage loan if the primary borrower defaults on the loan. A co-borrower on the other hand is someone whos equally liable for each payment ie. Web Both co-signers and co-borrowers strengthen your mortgage application.

The lender also must give you a document called the Notice to. Web To qualify as a cosigner youll need to provide financial documentation with the same information needed when you apply for a loan. Ad Are you eligible for low down payment.

The lender will look at a co-signer or co-borrowers finances to determine if they can. Find all FHA loan requirements here. Choose Smart Get a Mortgage Today.

Web A co-signer should have better credit and income than the primary borrower. The co-signer is obligated to pay any missed payments and even the full amount of the loan if the borrower doesnt pay. The cosigner guarantees the debt of the loan but.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web To become a cosigner you must first sign loan documents that tell you the terms of the loan. Compare Now Skip The Bank Save.

Save Real Money Today. Get Instantly Matched with Your Ideal Mortgage Lender. Web A co-signer is someone who helps a prospective borrower with poor credit qualify for a loan by pledging to repay the loan if the borrower does not.

In some cases a co-signer is a family member or friend of the loan applicant such as a. Web A cosigner with a steady paycheck and low debt-to-income ratio DTI may give the lender assurance that someone will be able to make the mortgage payments. Due to their financial.

Web Common with parents guardians and siblings a cosigner is someone that agrees to pay the buyers mortgage payments if they cant afford them or default on their. Web Typically a co-signer on a mortgage will be a parent spouse friend or a family member. Web Because a co-signer guarantees that a mortgage will be paid off the co-signers credit score credit history and income can be used to bolster an otherwise weak applicants.

Web As a co-signer youll need to meet the minimum credit score requirements for the type of loan the borrower is trying to qualify for. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web A co-signer is someone who agrees to be a backup for the loan payments.

:max_bytes(150000):strip_icc()/can-you-transfer-a-mortgage-315698-5b881051427b4839a5bd362f7f973b16.jpg)

How To Transfer A Mortgage To Another Borrower

Cosigning On A Mortgage What You Need To Know Timesproperty

Can A Co Signer Or Guarantor Help You Get A Mortgage In New York

Cosigning A Mortgage Are You Wrecking Your Finances By Helping A Friend

Can A Co Signer Help You Qualify For A Mortgage

:max_bytes(150000):strip_icc()/184883242-56a2eea45f9b58b7d0cfc942.jpg)

Learn About Co Signing A Loan

5 Things You Need To Know Before You Co Sign A Mortgage Ingram Mortgage Team

20 Hour Safe Loan Originator Pre Licensing 2016 2017 Slides

How Mortgage Co Signing Works Howstuffworks

:max_bytes(150000):strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

How To Remove A Name From A Mortgage When Allowed

Ultimate Guide To Getting A Personal Loan With A Cosigner

Canadian Mortgage Professionals

Cosigning On A Mortgage What You Need To Know Timesproperty

How Much More Will A Cosigner Increase A Mortgage Budgeting Money The Nest

Can You Cosign On A Loan Total Mortgage

Should You Co Sign A Mortgage Loan Mortgages And Advice U S News

Co Signing A Mortgage For A Relative Should I Or Should I Not At Home Colorado